- Web Desk

- Jan 08, 2026

Tesla stock rebounds, yet critics warn it’s still ‘wildly overvalued’

-

- Web Desk

- Sep 11, 2025

WEB DESK: Tesla’s stock is once again testing investors’ patience. The electric carmaker’s shares closed the September 10 trading session at $346.97, not far from their recent rebound highs, yet still down roughly 8 percent on the year.

It’s been a bumpy 2025 for the company, and Wall Street cannot seem to decide whether this is the moment to buy, or the moment to bail. In the latest Tesla news, TSLA traded between $346.07 and $356.33 on Wednesday, giving it a market capitalisation of about $1.1 trillion.

The stock has rallied in four of the past five sessions, but that masks a messy backdrop: declining vehicle sales, fading US electric vehicle tax credits set to expire at the end of this month, and intensifying competition from global automakers.

And then there is the Elon Musk factor.

The Musk effect: bold promises, polarising presence

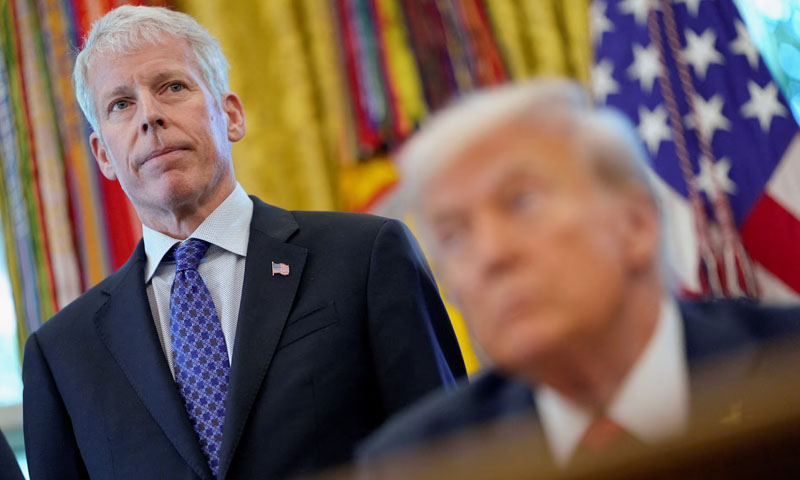

Few CEOs exert as much gravitational pull on their company’s stock price as Musk does on Tesla’s. The billionaire’s outspoken public stances and alignment with the Trump administration have alienated some investors, who worry his personal politics bleed into Tesla’s brand.

Musk, for his part, remains unfazed. Earlier this month, he posted on X that he expects “~80 percent of Tesla’s value will be Optimus”, referring to the company’s humanoid robot project. It is classic Musk, painting a future so audacious it almost dares investors to bet against him.

That audacity divides Wall Street. David Giroux, a well-known contrarian fund manager at T. Rowe Price, told a Barron’s roundtable that Tesla is so overpriced he wouldn’t touch it even after a hypothetical 90 percent crash. “It’s just crazy overvalued,” he said bluntly.

Energy pivot meets robotaxi dreams

While its core car business has cooled, Tesla is quietly expanding in energy. On Monday, the company unveiled the Megapack 3 and the Megablock, its latest large-scale energy storage systems designed to make wind and solar power more dependable.

The Megablock integrates batteries, switchgear, and transformers into a single unit, which Tesla says cuts installation time by 23 percent and reduces construction costs by 40 percent. William Blair analyst Jed Dorsheimer called it “a game-changer for grid storage customers” and said Tesla’s energy unit is showing “positive momentum” alongside its long-touted robotaxi ambitions.

Those robotaxi ambitions, meanwhile, now face fresh competition. Amazon-backed Zoox has begun offering its own robotaxi rides in Las Vegas, highlighting how crowded the self-driving race is becoming.

Wall Street’s split screen

Tesla’s second-quarter earnings showed a year-on-year drop in automotive revenue, and Wells Fargo says August sales data suggest weakness is persisting. Deliveries across three key markets were 9 percent lower than last year, though 37 percent higher than July. The bank still expects Tesla to miss third-quarter delivery targets and maintains an Underweight rating with a $120 price target.

Morgan Stanley takes the opposite view. Its analysts argue Musk’s proposed $1 trillion compensation package aligns his long-term interests with shareholders and keeps him locked in as Tesla’s driving force.

They see his ambition to hold a 25 percent “blocking minority” stake as key to preserving his influence, especially as Tesla expands into AI-powered manufacturing and physical AI products.

For now, Tesla shares seem stuck in limbo, drifting between gravity and hype. If the company can deliver on even a sliver of its promises, it could mark a turning point. But until then, Tesla remains Tesla: thrilling, infuriating, and impossible to ignore.

Read next: Pakistan’s stock market surges past 157,800 in early run